Bestpass-Fleetworthy Solutions Announces Rebrand, Changes Name to Fleetworthy

Can Fleetworthy Support IFTA and IRP Requirements?

Yes, Fleetworthy Solutions supports fleet compliance with both the International Fuel Tax Agreement (IFTA) and the International Registration Plan (IRP), two critical regulatory programs for carriers that operate across multiple U.S. states and Canadian provinces. Managing IFTA and IRP requirements manually is time-consuming, error-prone, and risky. Fleetworthy streamlines this process by automating data collection, reporting, and renewal workflows to help fleets maintain compliance and reduce administrative burden.

IFTA Compliance:

IFTA requires carriers to file quarterly fuel tax reports that account for miles traveled and fuel consumed in each jurisdiction. Fleetworthy supports IFTA compliance through:

- Mileage and Fuel Data Integration: Fleetworthy integrates with telematics and fuel card providers to collect accurate mileage and fuel purchase data across jurisdictions. This eliminates the need for manual entry and ensures precise reporting.

- Automated IFTA Reporting: The platform compiles the necessary data into formatted IFTA reports, calculates tax obligations for each state or province, and tracks submission deadlines. This reduces the risk of misreporting and penalties for late or inaccurate filings.

- Audit-Ready Documentation: All records required for IFTA audits, such as trip sheets, odometer readings, and fuel receipts, are stored digitally within the Fleetworthy system. If audited, fleets can easily produce the documentation required by tax authorities.

IRP Compliance:

The International Registration Plan allows carriers to register vehicles for operation across multiple jurisdictions with a single account. Fleetworthy helps manage IRP requirements by:

- Tracking Jurisdictional Mileage: Using telematics and trip data, Fleetworthy captures miles driven per jurisdiction, which is essential for calculating registration fees and maintaining IRP eligibility.

- Managing Renewals and Deadlines: Fleetworthy alerts managers when IRP renewal dates are approaching, ensuring that all paperwork is submitted on time and preventing registration lapses.

- Documentation and Recordkeeping: Required IRP documents, such as registration receipts, apportioned plates, and vehicle mileage records, are stored in the platform for easy access during audits or renewals.

- Support for Fleet Changes: Whether adding new vehicles, changing jurisdictions, or retiring assets, Fleetworthy helps update your IRP account and ensure that your fleet remains fully compliant with registration requirements.

By automating and centralizing IFTA and IRP processes, Fleetworthy reduces compliance risks, improves reporting accuracy, and saves time. This helps fleets avoid penalties, maintain operational flexibility across state and provincial lines, and stay focused on delivering results.

Need a Little More Info?

CPSuite Safety & Compliance

Fleetworthy’s legacy solution, CPSuite, allows fleets to track and manage vehicle compliance requirements effortlessly, as well as ensure drivers meet all safety and compliance standards.

With CPSuite, your fleet can easily navigate any challenges in the road ahead.

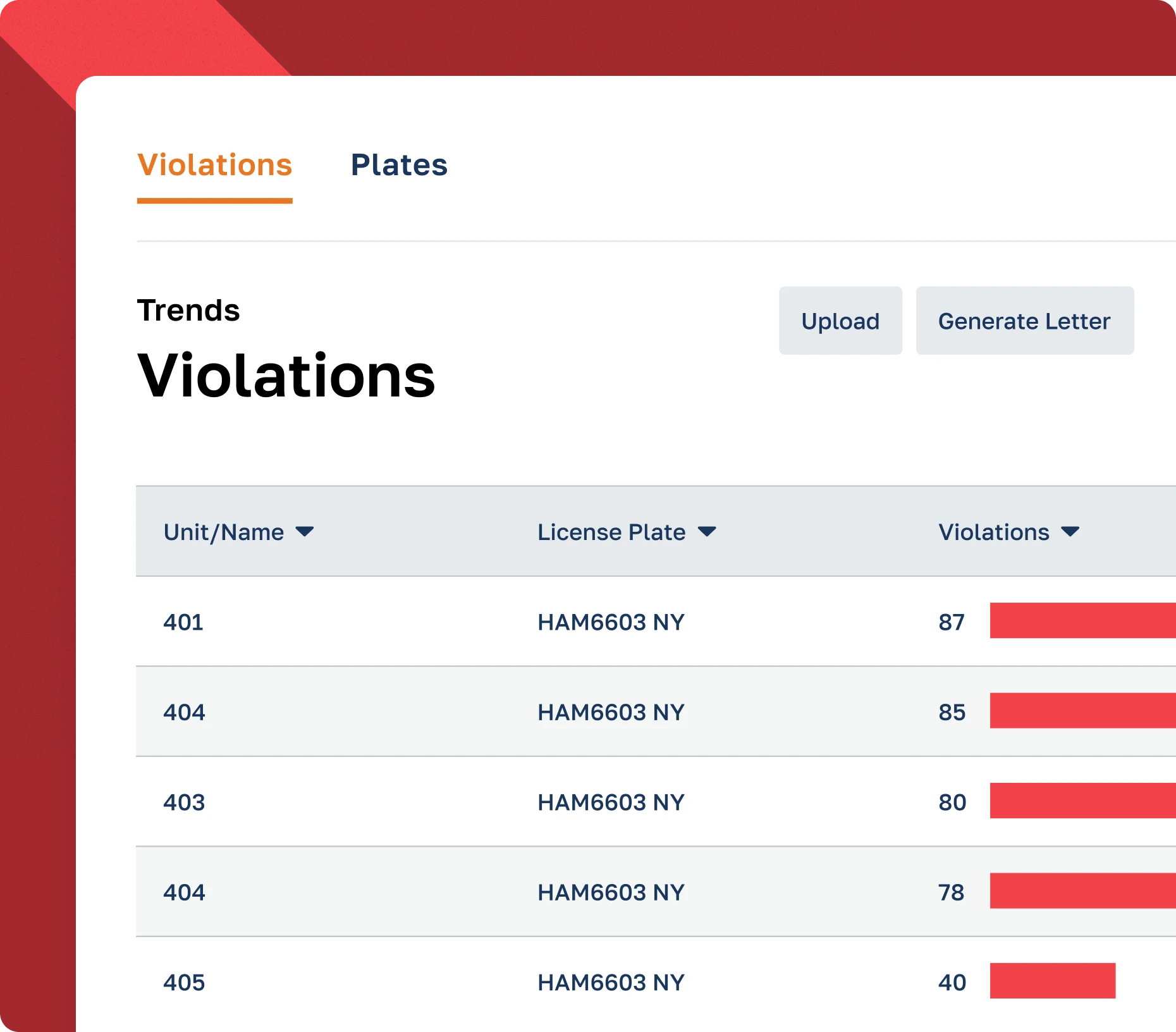

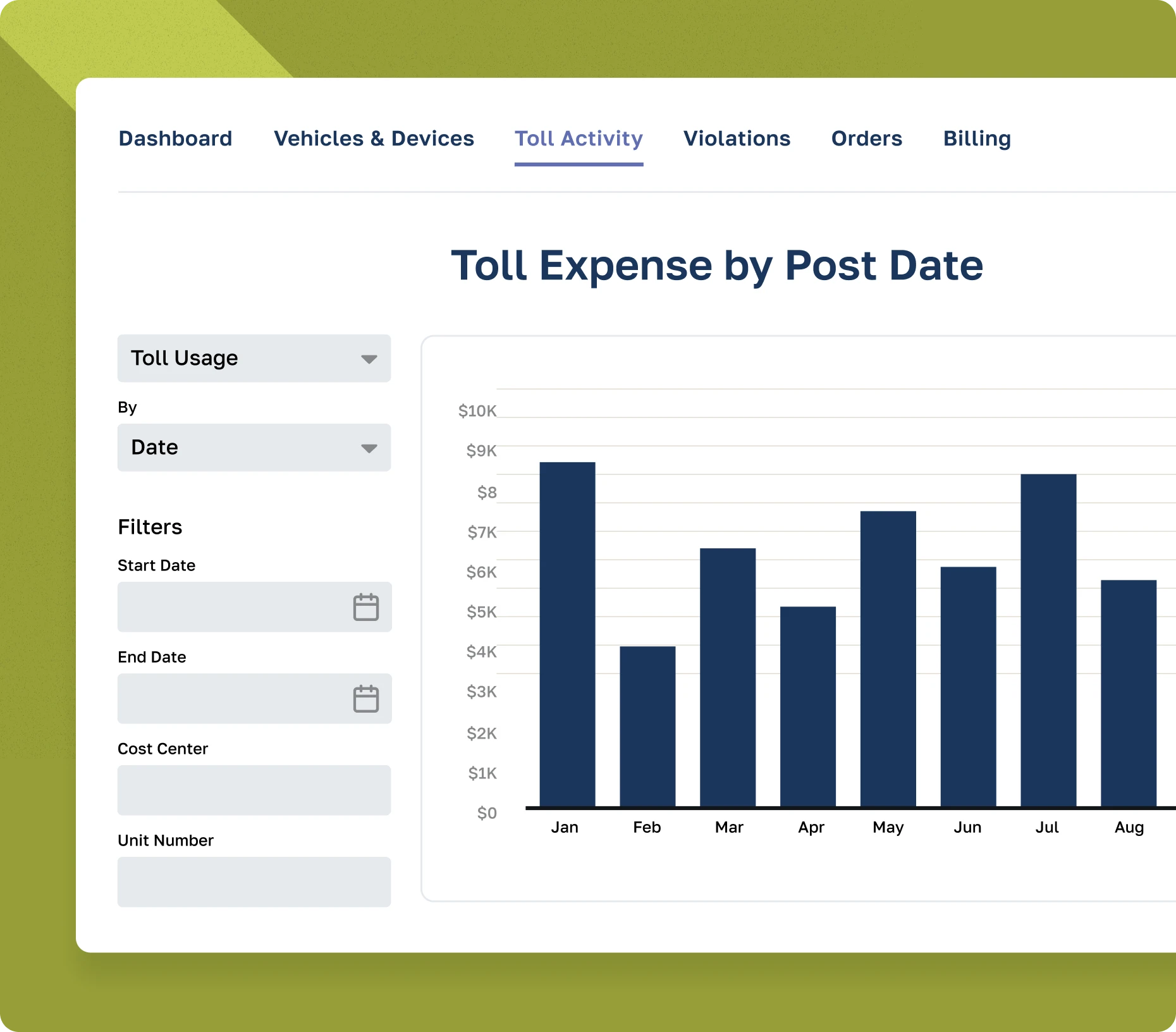

Bestpass Toll Management

Bestpass provides the leading toll management technology, allowing customers to hit the road with a single monthly statement, on-demand reporting with advanced analytics, and dedicated customer support.

With coverage for 100 percent of major U.S. toll roads, Bestpass gives you the most opportunity to save time and money.

Drivewyze Weigh Station Bypass

Drivewyze is North America’s top weigh station bypass provider, with 900+ locations and counting.

With Drivewyze by Fleetworthy, your fleet can access proactive in-cab safety alerts, skip weigh stations, and make better time.

Ready to Get Started?

The Complete Technology Suite

Looking for Even More?

Unsure What You Need?

Talk to one of our Experts today, and let us help you figure it out.