Bestpass-Fleetworthy Solutions Announces Rebrand, Changes Name to Fleetworthy

Does Fleetworthy Partner with Insurers or Brokers?

Yes, Fleetworthy actively partners with insurers and brokers to deliver enhanced safety, compliance, and risk management solutions that benefit both fleets and their insurance providers. These partnerships are built on the shared goal of reducing risk, improving safety outcomes, and lowering the total cost of fleet operations, including insurance premiums, claims, and liability exposure.

Fleetworthy’s solutions provide insurers and brokers with valuable, real-time visibility into a fleet’s safety and compliance performance. By integrating telematics data, driver behavior analytics, vehicle maintenance records, and compliance metrics into a centralized platform, Fleetworthy enables more accurate risk assessments and helps insurance partners identify high-performing fleets or emerging risks. This data-driven insight supports underwriting decisions, renewal strategies, and loss control efforts.

For brokers, Fleetworthy serves as a strategic ally in helping clients strengthen their safety programs and maintain FMCSA and DOT compliance. By offering access to advanced tools, such as Driver Qualification File (DQF) management, predictive risk analytics, and automated compliance tracking, Fleetworthy enables brokers to provide value-added services that go beyond insurance placement. This creates stronger, long-term client relationships and demonstrates a commitment to operational excellence.

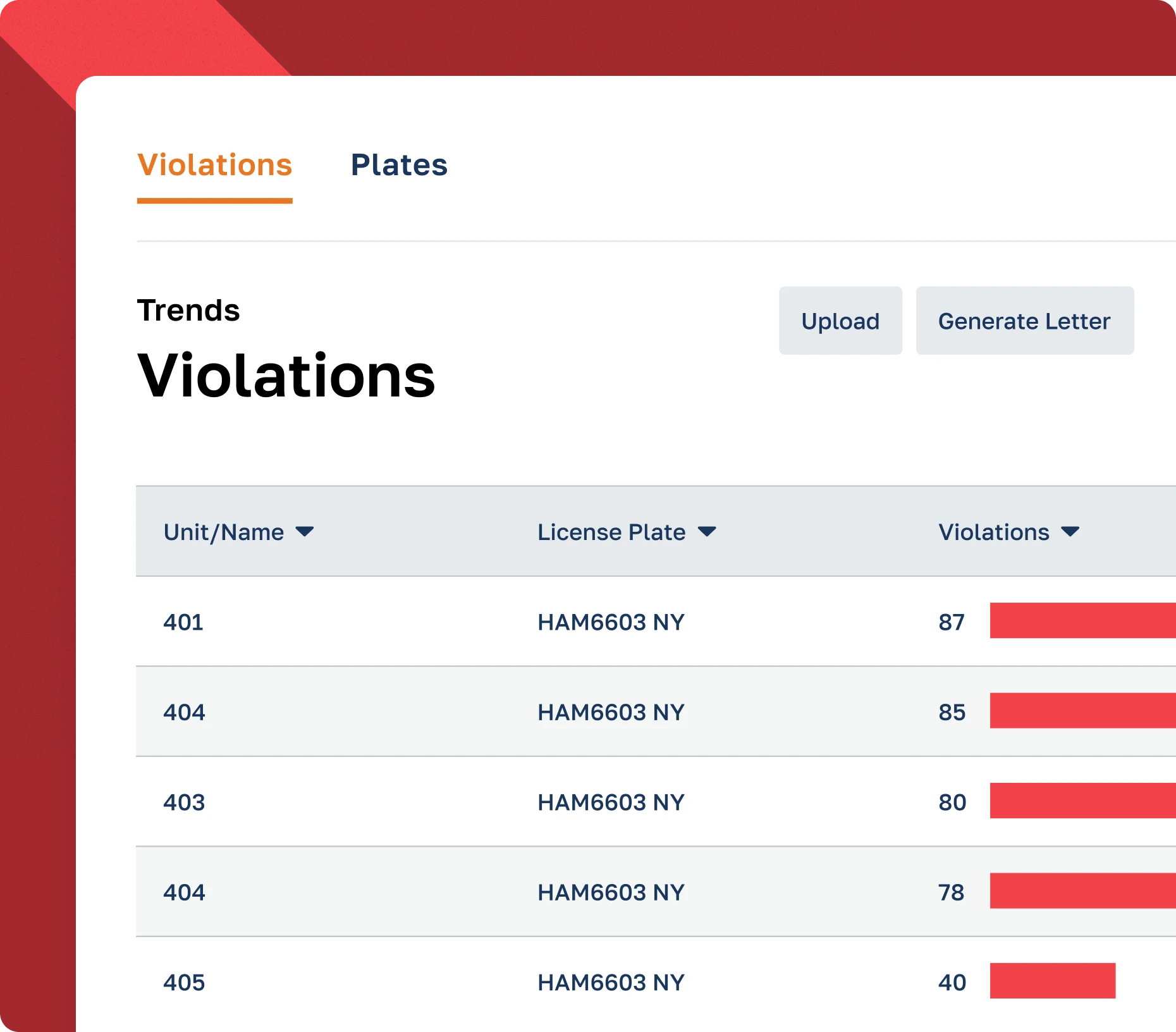

Fleetworthy also collaborates with insurers and brokers on joint safety initiatives and customized compliance programs. These partnerships often include shared goals for reducing crashes per million miles, lowering CSA scores, or addressing specific risk areas like hours-of-service violations, distracted driving, or maintenance-related incidents. In many cases, insurers may offer premium incentives or discounts to fleets using Fleetworthy’s platform due to the improved risk posture and accountability it provides.

Additionally, Fleetworthy supports claims mitigation efforts by providing comprehensive documentation and incident data. In the event of an accident or compliance investigation, insurers and brokers can rely on Fleetworthy’s detailed driver records, telematics evidence, and compliance history to support investigations and reduce liability exposure.

In summary, Fleetworthy partners closely with insurers and brokers to create a more connected, transparent, and proactive approach to fleet risk management. By aligning safety technology with insurance strategy, these partnerships help fleets reduce costs, improve outcomes, and build a stronger foundation for long-term success.

Need a Little More Info?

CPSuite Safety & Compliance

Fleetworthy’s legacy solution, CPSuite, allows fleets to track and manage vehicle compliance requirements effortlessly, as well as ensure drivers meet all safety and compliance standards.

With CPSuite, your fleet can easily navigate any challenges in the road ahead.

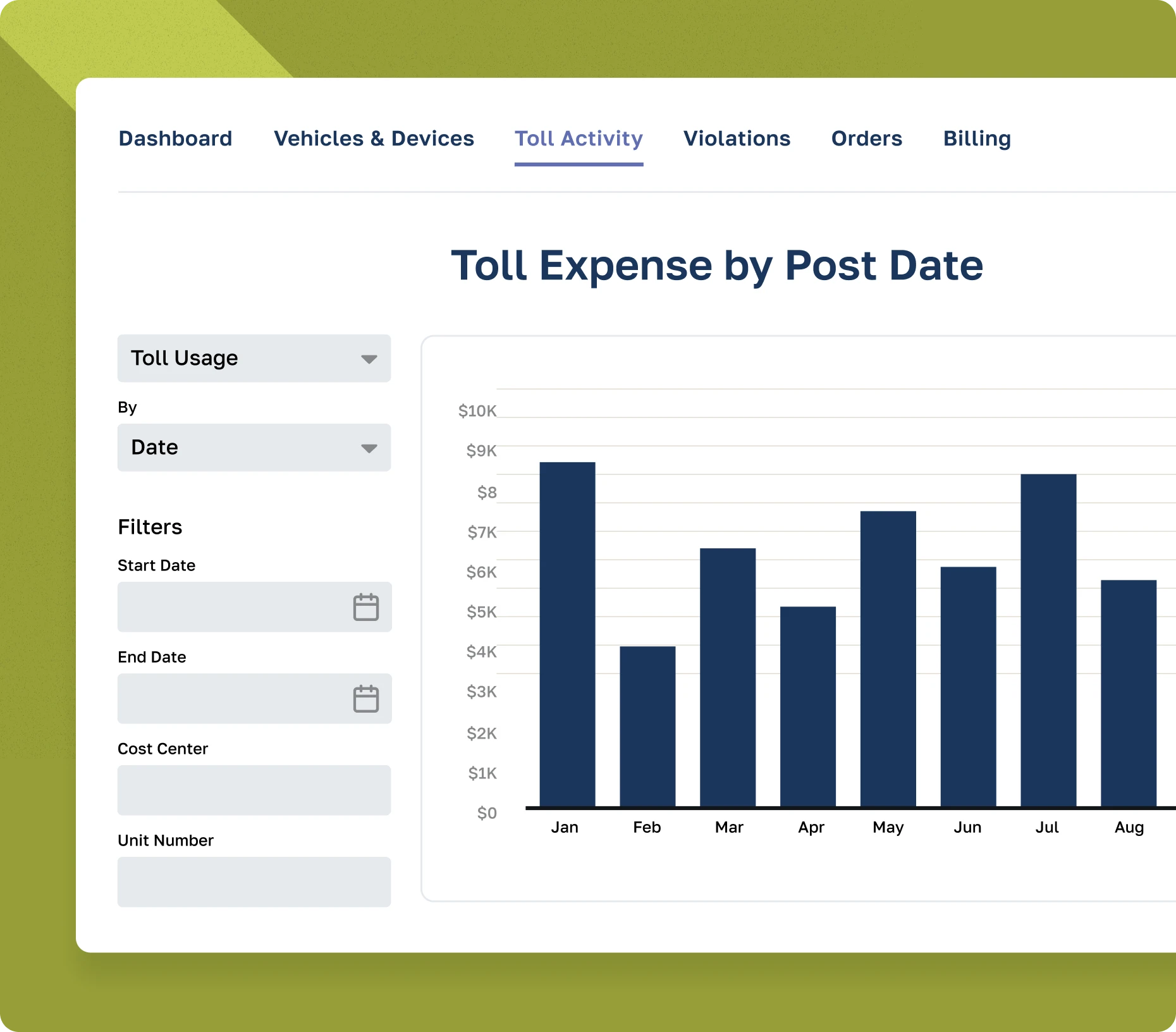

Bestpass Toll Management

Bestpass provides the leading toll management technology, allowing customers to hit the road with a single monthly statement, on-demand reporting with advanced analytics, and dedicated customer support.

With coverage for 100 percent of major U.S. toll roads, Bestpass gives you the most opportunity to save time and money.

Drivewyze Weigh Station Bypass

Drivewyze is North America’s top weigh station bypass provider, with 900+ locations and counting.

With Drivewyze by Fleetworthy, your fleet can access proactive in-cab safety alerts, skip weigh stations, and make better time.

Ready to Get Started?

The Complete Technology Suite

Looking for Even More?

Unsure What You Need?

Talk to one of our Experts today, and let us help you figure it out.