Bestpass-Fleetworthy Solutions Announces Rebrand, Changes Name to Fleetworthy

Can Fleetworthy Reduce Insurance Premiums or Improve Insurability?

Yes, Fleetworthy Solutions can play a significant role in reducing insurance premiums and improving a fleet’s overall insurability by enhancing safety performance, increasing regulatory compliance, and providing the data transparency insurers look for when evaluating risk. While Fleetworthy is not an insurance provider itself, its platform and services directly impact the factors underwriters use to assess a fleet’s risk profile and pricing.

Insurance companies base premiums on a wide range of criteria, including accident history, CSA scores, violation trends, driver turnover, maintenance practices, audit outcomes, and overall fleet compliance. Poor performance in any of these areas can lead to higher premiums, policy exclusions, or even denial of coverage. Conversely, fleets that demonstrate strong safety records, low violation rates, and proactive risk management are often rewarded with better rates and broader coverage options.

Here’s how Fleetworthy helps improve these outcomes:

- Proactive Compliance and Safety Management: Fleetworthy ensures that fleets stay compliant with FMCSA, DOT, IFTA, and IRP regulations through automated monitoring of driver and vehicle records, real-time alerts, and centralized document management. This reduces the likelihood of violations, audit failures, and costly out-of-service events, all of which insurers consider high-risk indicators.

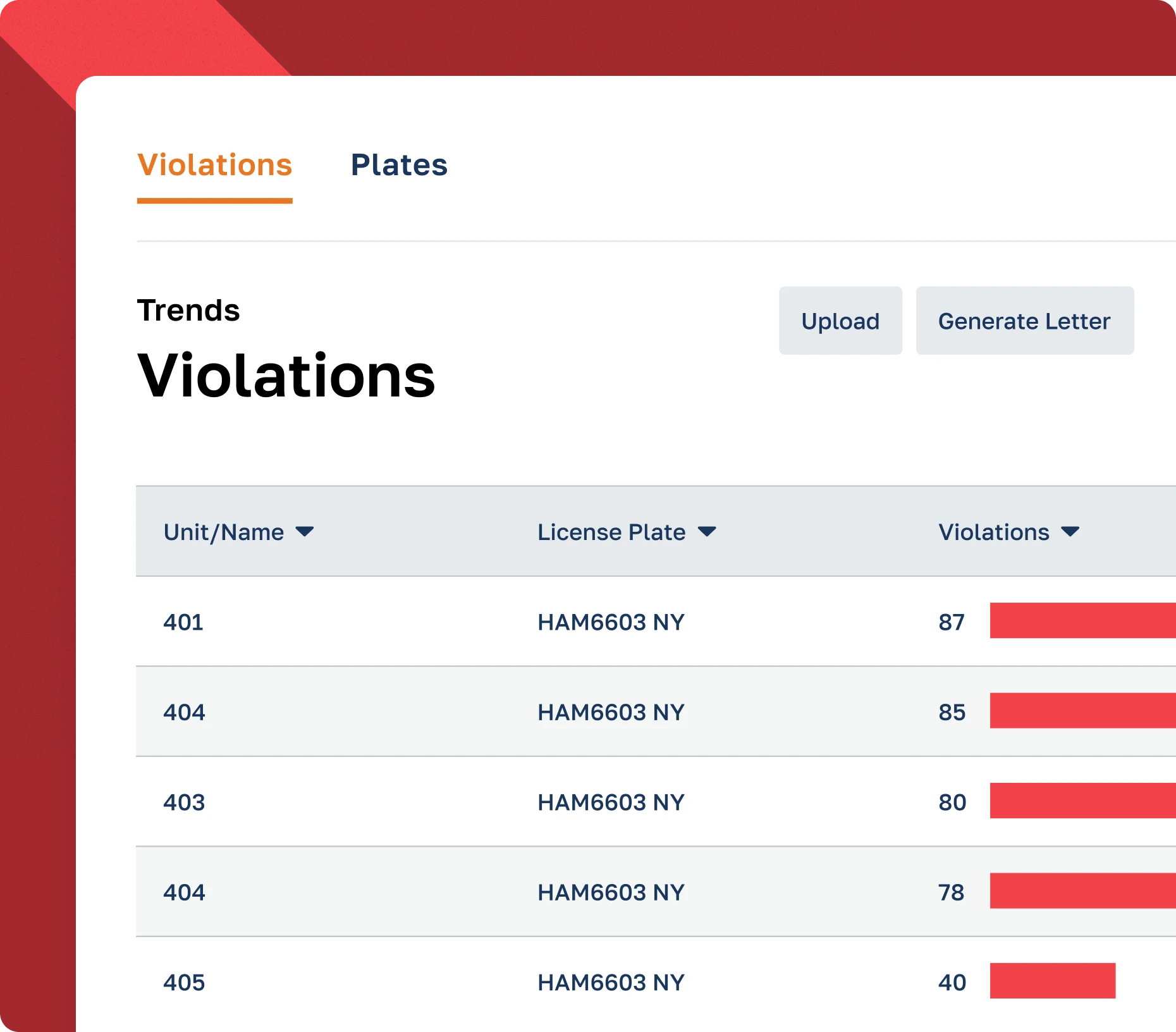

- Improved CSA Scores and Inspection Outcomes: By tracking and helping reduce CSA BASIC violations (Unsafe Driving, HOS, Vehicle Maintenance, etc.), Fleetworthy contributes directly to lowering a fleet’s DOT safety profile. Insurance underwriters often use CSA data when evaluating commercial fleets, and improvements here can lead to more favorable premium rates.

- Accident Prevention and Driver Risk Reduction: Fleetworthy’s integration with telematics, ELDs, and dashcams enables real-time monitoring of risky behaviors such as speeding, harsh braking, and fatigue. The platform identifies at-risk drivers early and supports corrective action through coaching and training, reducing the likelihood of accidents. Fewer incidents over time translate into better loss history, a key factor in lowering insurance costs.

- Documentation and Claims Defense:

Fleetworthy maintains a digital paper trail of safety practices, compliance actions, maintenance logs, and incident investigations. In the event of a claim or lawsuit, this documentation can be used to defend against liability, demonstrate due diligence, and reduce the financial impact of litigation, something insurers highly value. - Enhanced Transparency for Underwriting: Fleets using Fleetworthy can present underwriters with detailed safety performance reports, historical compliance trends, and evidence of structured safety management. This level of transparency builds trust with insurance partners and often leads to more favorable underwriting terms.

- Support for Insurance Reviews and Renewals: Fleetworthy’s reporting tools help prepare fleets for insurance renewals by clearly showing year-over-year improvements in safety metrics, compliance scores, driver behavior, and incident reduction. These reports can be shared directly with brokers or insurers to support premium negotiations.

In summary, while Fleetworthy does not guarantee lower premiums, it helps fleets create the conditions that insurers reward, reduced risk exposure, fewer violations, fewer claims, and a culture of safety and accountability. Fleets that use Fleetworthy are better positioned to negotiate competitive insurance rates, qualify for coverage with high-quality carriers, and avoid premium spikes driven by poor performance or inadequate documentation.

Need a Little More Info?

CPSuite Safety & Compliance

Fleetworthy’s legacy solution, CPSuite, allows fleets to track and manage vehicle compliance requirements effortlessly, as well as ensure drivers meet all safety and compliance standards.

With CPSuite, your fleet can easily navigate any challenges in the road ahead.

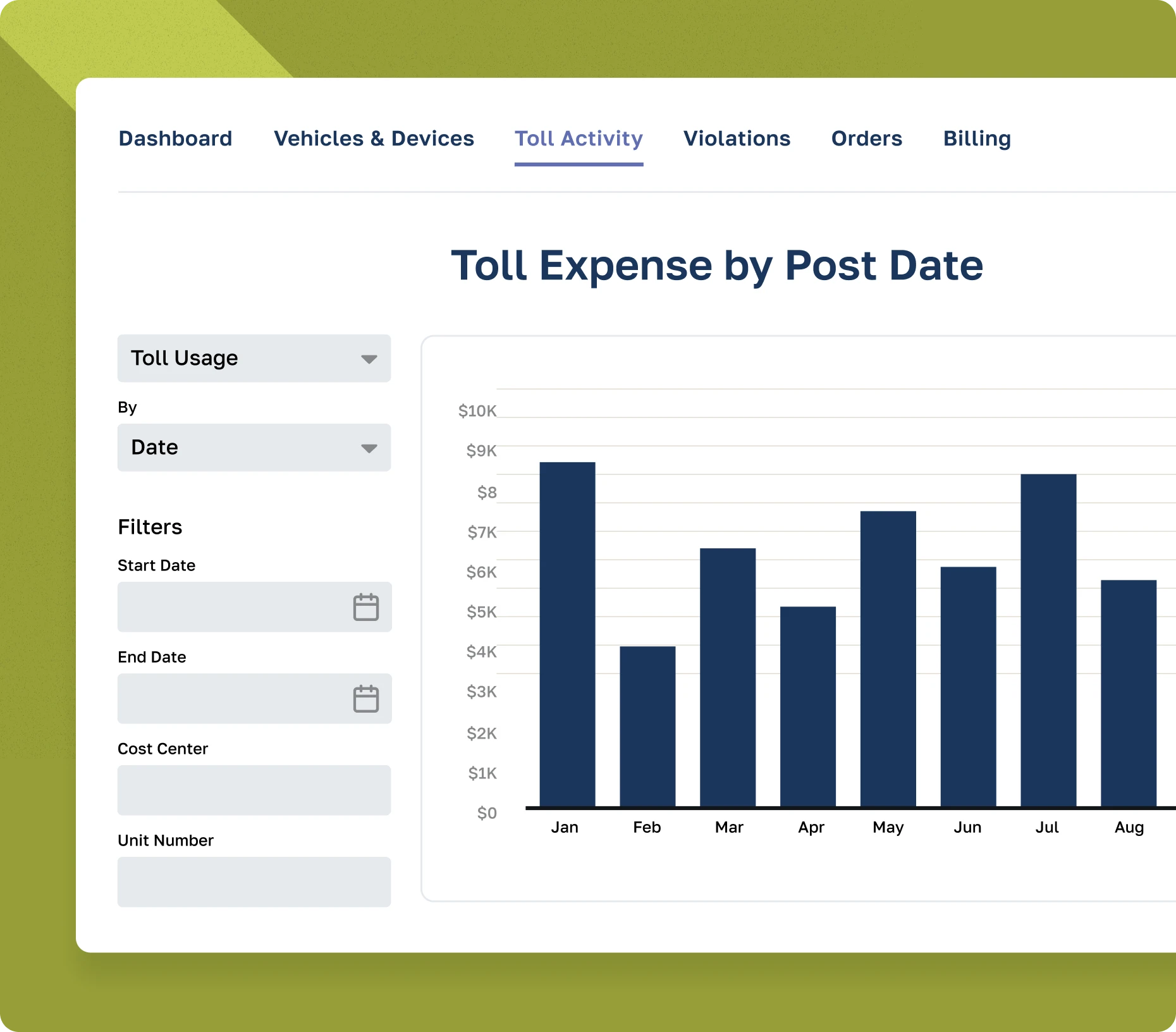

Bestpass Toll Management

Bestpass provides the leading toll management technology, allowing customers to hit the road with a single monthly statement, on-demand reporting with advanced analytics, and dedicated customer support.

With coverage for 100 percent of major U.S. toll roads, Bestpass gives you the most opportunity to save time and money.

Drivewyze Weigh Station Bypass

Drivewyze is North America’s top weigh station bypass provider, with 900+ locations and counting.

With Drivewyze by Fleetworthy, your fleet can access proactive in-cab safety alerts, skip weigh stations, and make better time.

Ready to Get Started?

The Complete Technology Suite

Looking for Even More?

Unsure What You Need?

Talk to one of our Experts today, and let us help you figure it out.